Financing Advisory for Renewable Energy & Energy-Efficient Projects

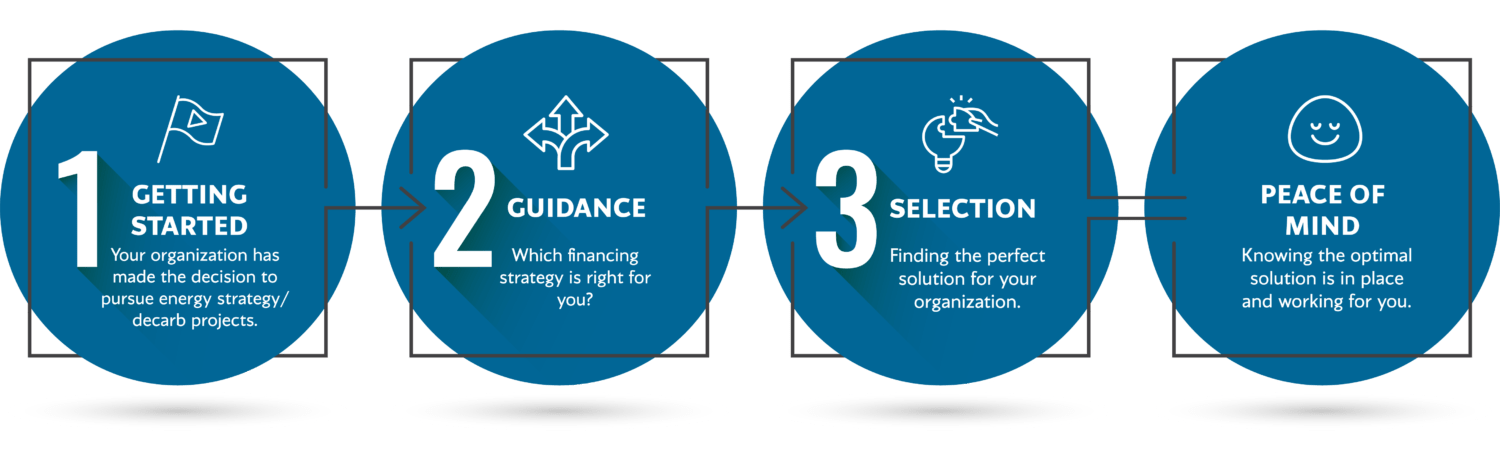

Many corporate and tax-exempt entities are pursuing implementation of a long-term energy strategy and development of decarbonization projects for various purposes — efficiency, resilience, and to meet internal carbon neutrality objectives and federal/state-level mandates and to modernize their energy infrastructure. Fortunately, the timing couldn’t be better! An increasing number of federal and state-level incentives coupled with the availability of investor capital has made decarbonization projects not only achievable, but financially attractive for an organization. Implementing the right financing strategy is instrumental in preserving capital and reducing operating expenses. However, it requires very specialized expertise in financing and connections to the appropriate investor networks. Such expertise is often not adequately staffed inside an organization and obtaining it can be costly if the organization engages traditional financial sources.

As a result, organizations may be missing business opportunities and experiencing increased pressure in the process. This is particularly relevant in tax-exempt sectors such as Healthcare and Universities, as owners are navigating pandemics, power resilience concerns, and increasingly “doing no harm” as it relates to reaching carbon neutrality. The lack of financing expertise is an added stressor.

Regardless of the project’s stage, size, asset class, or timeline, we partner with our clients in developing the appropriate financing strategy for renewable energy and energy efficient projects. Our financing advisory services are seamlessly integrated with Mazzetti’s core consulting and project development services and cover the spectrum:

Regardless of the project’s stage, size, asset class, or timeline, we partner with our clients in developing the appropriate financing strategy for renewable energy and energy efficient projects. Our financing advisory services are seamlessly integrated with Mazzetti’s core consulting and project development services and cover the spectrum:

With a proven track record of closing over $1.5 billion renewable project finance transactions, supported by a unique combination of a broad investor network, and business and technical expertise, our Financing Advisory Services include:

With a proven track record of closing over $1.5 billion renewable project finance transactions, supported by a unique combination of a broad investor network, and business and technical expertise, our Financing Advisory Services include:

- Financing Strategy: Developing an Energy Financing Strategy is important for an organization. The Inflation Reduction Act (IRA) and local-level incentives are benefiting tax-exempt organizations by providing significant financial incentives for project ownership and 3rd-party financing. We develop a comprehensive Energy Financing Strategy for the entire organization (or parts of it), including:

- Identify IRA and local incentives matching the organization’s ESG targets and energy plan.

- Identify which renewable energy and/or energy efficiency projects will benefit most from the IRA and other local incentives. This includes on-site generation, energy retrofits, microgrids, fuel replacement and electrification.

- Present 3rd-party financing options available to client.

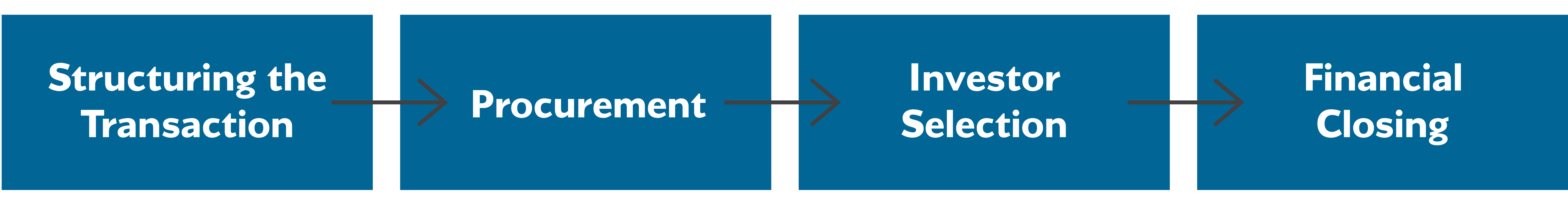

- Structured Finance: We assist our clients by developing and evaluating project financing structures (including Energy Services Agreements, Energy Savings Agreement, Tax Partnerships, Capital and Operating Leases, PPP, TELP), and project ownership models (client or 3rd-party owned).

- Financial Modeling: We develop detailed financial models (proformas) to evaluate the impact that different project design options, ownership models, offtake options, and finance structures have on project economics, with a focus on the clients operating expense and financial sustainability (ratings and access to capital). The financial model is updated and used in all phases of a typical project development cycle: during the planning phase, it assists in developing the project specs; during procurement, it assists evaluating vendor bids; and finally in the project development phase, it tracks actual economics.

- Project Funding: Some clients benefit from direct project ownership, with or without 3rd-party financing, while others benefit from 3rd-party ownership and financing. We introduce the transaction to qualified investors/lenders and develop and execute a competitive procurement process, soliciting and evaluating financing proposals.

- Deal Execution: We represent our clients in financial closings with investors and lenders to secure the project funds, and with filing with federal or local authorities to secure IRA and local incentives.

- Offtake Agreements: Offtake agreements are an integral part of Structured Finance and play a fundamental role in overall project economics. We evaluate and negotiate detailed business terms of offtake agreements, including Power Purchase Agreements (PPA), Energy Service Agreements (ESA), Fuel Service Agreements, and Purchase and Sell Agreements for Renewable Energy Credits (REC/SREC) and Carbon Credits.

Clients

We primarily work with tax-exempt and corporate clients in the Healthcare and Life Sciences sector, including Valley Children’s Hospital, large non-profit healthcare systems, and Blue Cross Blue Shield. Typically, the ultimate objective is to design and implement comprehensive decarbonization projects. Depending on the client, projects can include onsite generation, microgrids, energy efficiency, energy procurement, electrification, and fuel replacement.

Interested in a free consultation:

Contact Us